how to change how much taxes are taken out of paycheck

You need to submit a new W-4 to your employer giving the new amounts to be. Calculate Federal Insurance Contribution.

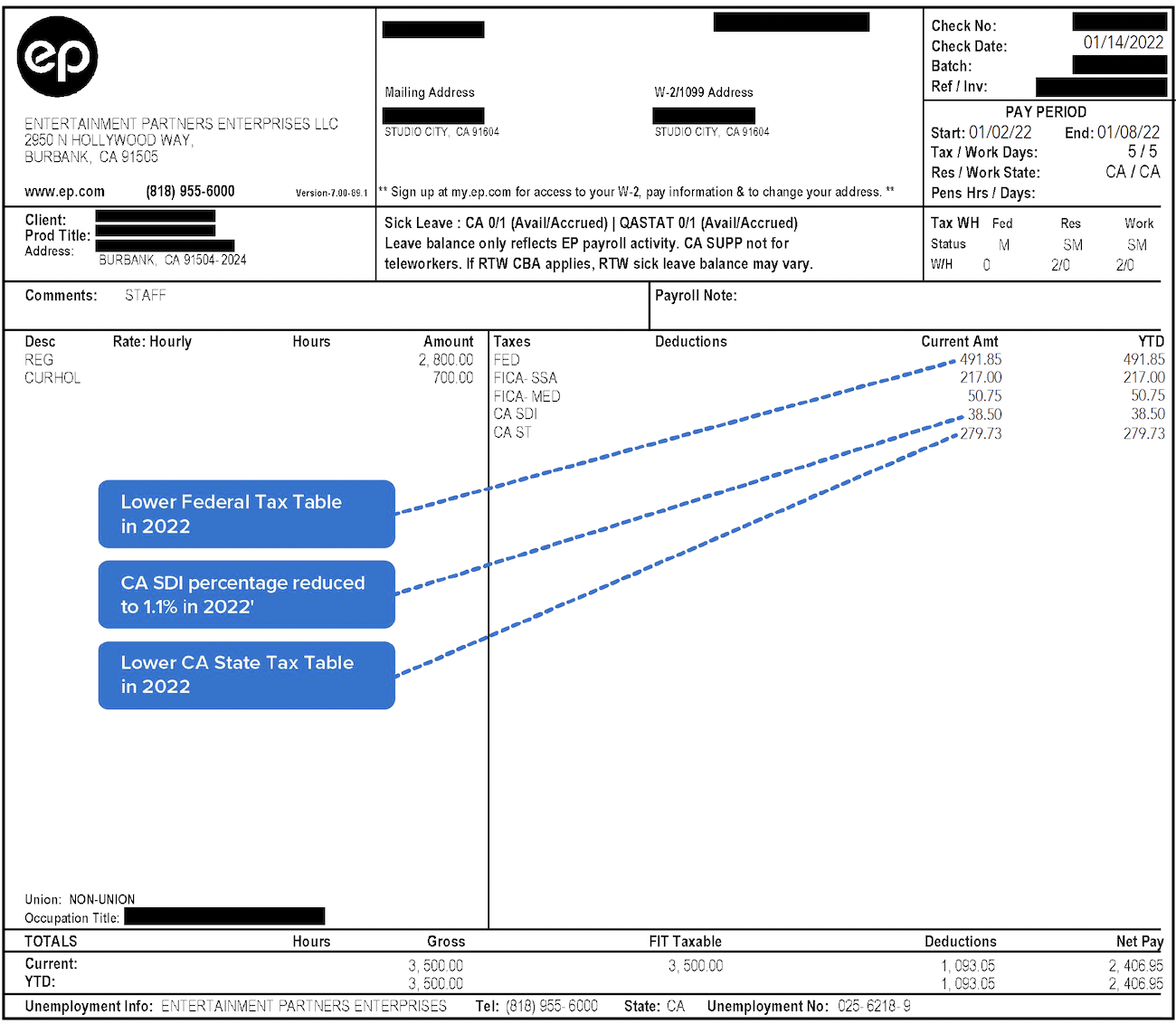

Decoding Your Paystub In 2022 Entertainment Partners

The amount of income earned and.

. How to have less tax taken out of your paycheck. For a single filer the first 9875 you earn is taxed at 10. The amount withheld depends on.

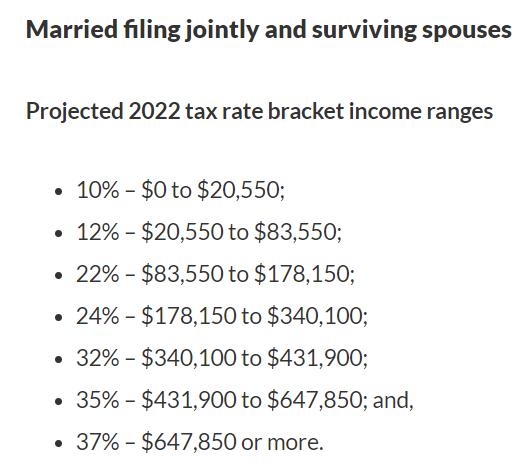

Review current tax brackets to calculate federal income tax. Only the very last 1475 you earned. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Enter your personal information. How Much Tax Is Deducted From My Paycheck Ontario 2021. By placing a 0 on line 5 you.

According to the Ontario tax rates for 2021 the amount earned up to 45142 is taxed at a rate of 5. Take these steps to determine how much tax is taken out of a paycheck. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same.

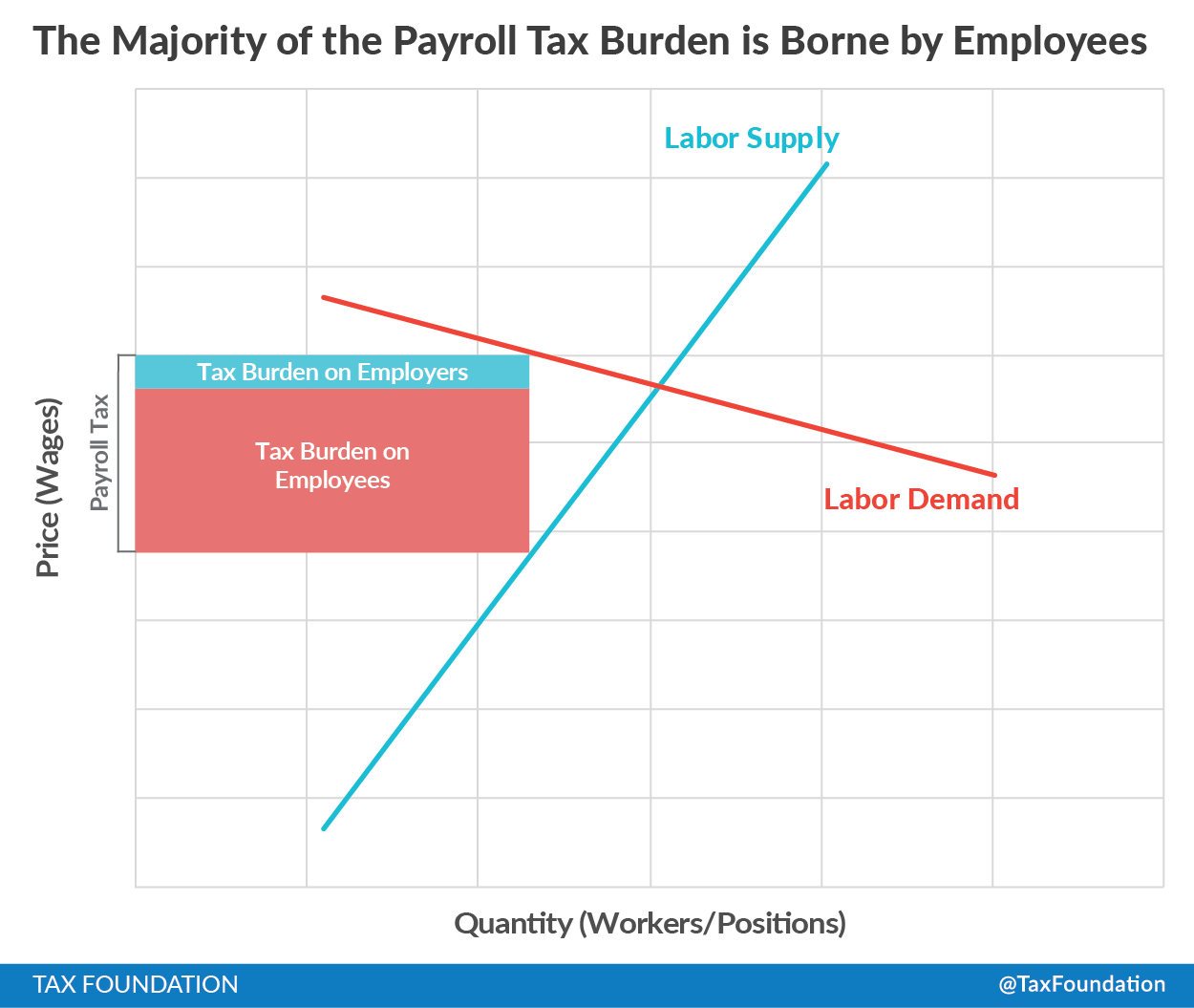

These are contributions that you make before any taxes are withheld from your paycheck. Heres how to make it work for you. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

To adjust your withholding is a pretty simple process. The employer portion is 15 percent and the. How withholding is determined.

How do I withhold less taxes on 2020. Multiple jobs or spouse works. The current rate for Medicare is 145 for the employer and 145 for.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Check your tax withholding every year especially. Child birth or adoption.

The amount of taxes taken out is decided by the total number of allowance you claim on line five. An example of how this works. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck.

If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on. If you simply want to increase your deduction a simple way is to specify an additional amount that you would like to see withheld on your paycheque on line 4 c of Form. When you file your tax return youd.

Form W-4 tells your employer how much tax to withhold from each paycheck. The first step is filling out your name address and Social Security number. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

How You Can Affect Your Michigan Paycheck. You can choose to have taxes taken out. IR-2018-222 IRS provides tax inflation adjustments for tax year 2019.

When you have a major life change. Three types of information an employee gives to their employer on Form. New job or other paid work.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Paycheck Taxes Federal State Local Withholding H R Block

Different Types Of Payroll Deductions Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

What Are Payroll Deductions Article

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Irs New Tax Withholding Tables

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Taxes On Paycheck On Sale 52 Off Www Ingeniovirtual Com

Check Your Paycheck News Congressman Daniel Webster

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Understanding Your Paycheck Credit Com

Important Tax Information Work Travel Usa Interexchange

How To Fill Out Form W 4 W4 Withholding Allowances Taxact

Paycheck Calculator Online For Per Pay Period Create W 4