reverse tax calculator australia

This easy-to-use calculator can help you figure out instantly how much your gross pay is based on your net pay. This calculator helps you to calculate the tax you owe on your taxable income.

Reverse Tax Calculator Net To Gross

The Australian Taxation Office website.

. Fields marked with an are required. In most cases your employer will deduct the income tax from your wages and pay it to the ATO. The more details you add the more accurate your refund estimate.

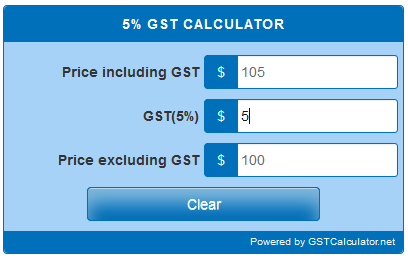

Simply enter your Gross Income and select earning period. To figure out how much GST was included in the price you have to divide the price by 11 2201120. Australian 2022 Tax Calculator.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. If you are under 21 or studying full time under 25 years well take care of your tax return from 79. Here are the Australian income tax rates and brackets for the 202122 financial year for Australian residents according to the Australian Taxation Office ATO.

To work out the price without GST you have to divide the amount by 11 22011200. Why this PAYG Calculator. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

Reverse Mortgage Calculator Saving Calculator Split Loan Calculator. 500 01 50 GST amount. Its quick free and easy to use.

Australian income is levied at progressive tax rates. Citizen living in Australia we will help you review your Tax. Income tax on your Gross earnings Medicare Levyonly if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings.

Show me tax rates for. 17 Aug 2021 QC 16608. Tax rate for all canadian remain the same as in 2017.

500 is GST exclusive value. Current HST GST and PST rates table of 2022. ATO tax withheld calculator or tax tables provided by the Australian Taxation Office ATO which your employer uses to calculate PAYG tax rounds your income and taxes to the nearest whole figure hence you may have some discrepancies with your actual pay on your payslip.

For each 1 over 180000. Our Tax Calculator uses exact ATO formulas when calculating your salary after income tax. 70 total with GST at 10 GST rate.

Tax planning tax advice. Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO. You can check any.

Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

Simply enter your numbers and our tax calculator will do the maths for you. To work out the cost including GST you multiply the amount exclusive of GST by 11. To calculate Australian GST at 10 rate is very easy.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. It will take between 2 and 10 minutes to use this calculator. This estimator will help you to work out an estimate of your gross pay and the amount withheld from payment made to.

Just multiple your GST exclusive amount by 01. Then find out how you can pay less tax. This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price.

When adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky. Adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky. Business tax.

How to calculate GST in Australia. CALCULATE YOUR REFUND NOW. 10 100 1 01 1 11.

This app is especially useful to all manner of professionals who remit taxes to government agencies. To get GST inclusive amount multiply GST exclusive value by 11. We will review your tax return and check that you have received the maximum refund.

Show tax rate table. For each 1 over 120000. It can be used for the 201314 to 202021 income years.

Instantly calculate your tax return refund by inputting your numbers into our Australian Tax Return Refund Calculator. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Amount without sales tax QST rate QST amount.

To figure out how much GST was included in the price you have to divide the price by 11 1101110. In addition to income tax there are additional levies such as Medicare. Finally Your Take Home Pay after deducting Income Tax and Medicare.

Add your details below then click Calculate. Current financial year 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009. If you are a US.

A pay period can be weekly fortnightly or monthly. Calculate Australian tax figures fast. You divide a GST inclusive cost by 11 to work out the GST component.

This Calculator will display. This link opens in a new window. This financial year started on 1 July 2021.

Income Tax Calculator Leasing Calculator Loan Comparison Calculator. How to calculate reverse GST formula To find the GST from a total divide the total amount by the GST rate divided by 100 and plus 1. JAWs Oz Tax Calculator for the Current Financial Year.

Here is how the total is calculated before sales tax. Includes 2 medicare levy and low income tax offset. 03 9511 8883 Email.

70 11 6364 cost before GST. Pty Ltd Australian Credit Licence 392184. Suite 8 14 Garden Boulevard Dingley Village VIC 3172 Phone.

Amount without sales tax GST rate GST amount. 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020. Total Income Gross Payments you received before tax.

500 is GST exclusive value. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. See the article.

Simply enter any one field press the calculate button and all the other fields will be shown. It can be used for the 201314 to 202021 income years. As well as entrepreneurs and anyone else who may need to figure out just how much of their sale should be recorded as tax collection.

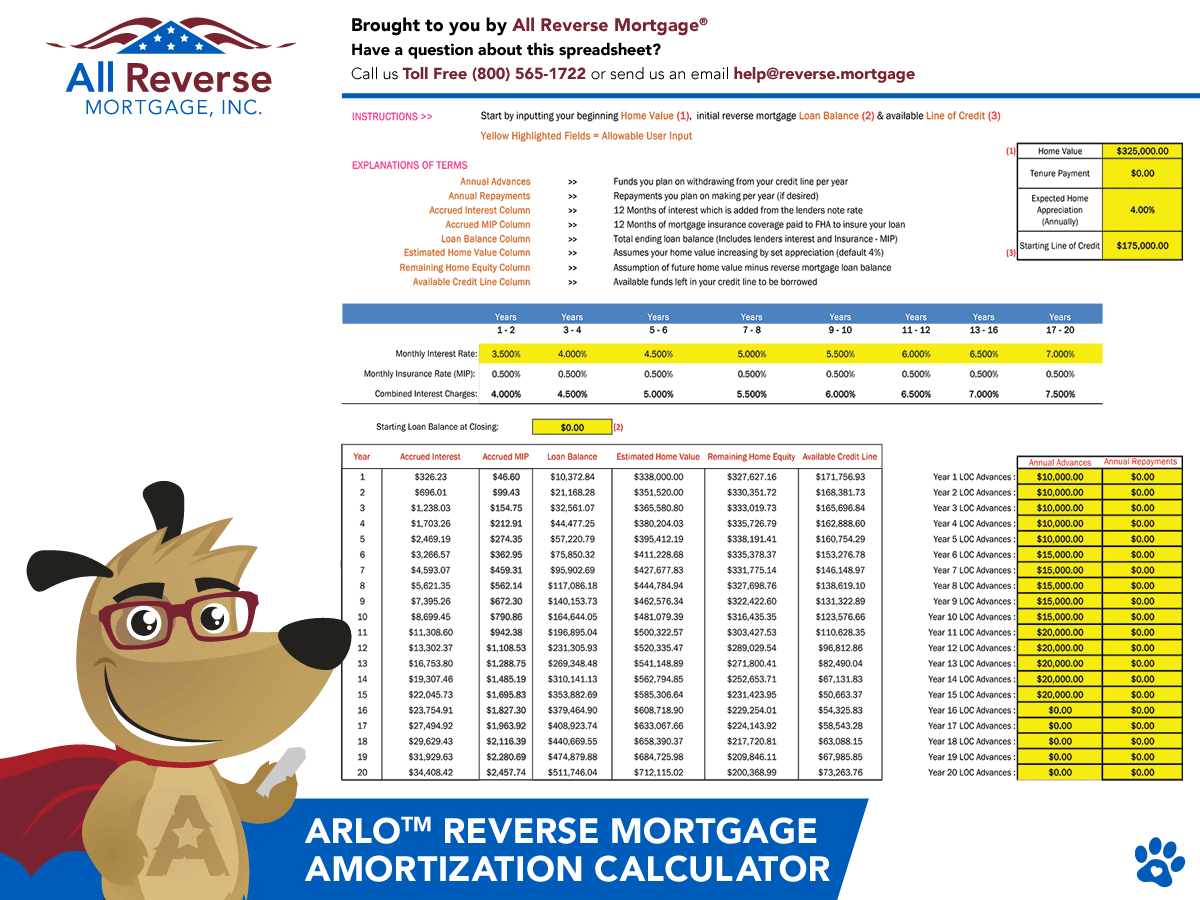

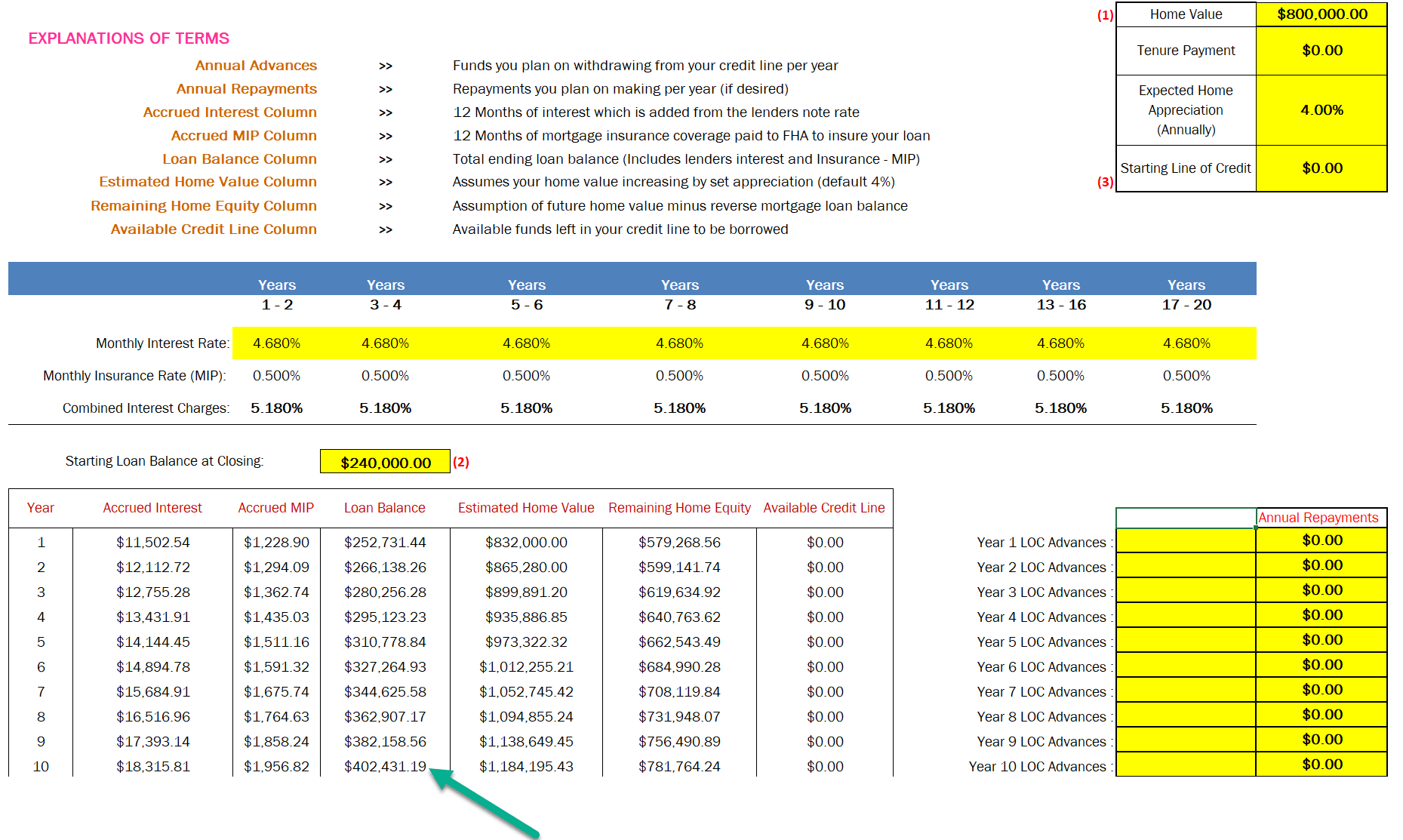

Free Reverse Mortgage Amortization Calculator Excel File

Contractor Payroll Salary Packaging Novated Leasing Contractor Payroll Services Http Kentucky Nef2 Com Contracto Payroll Managing Your Money Contractors

Using Your Home Equity To Purchase An Investment Property Mortgage Loans Home Equity Loan Home Loans

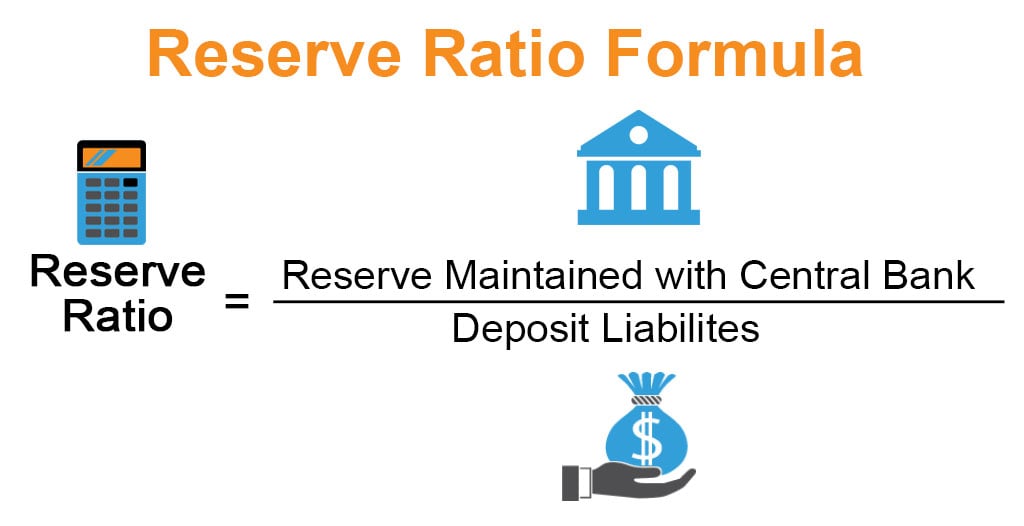

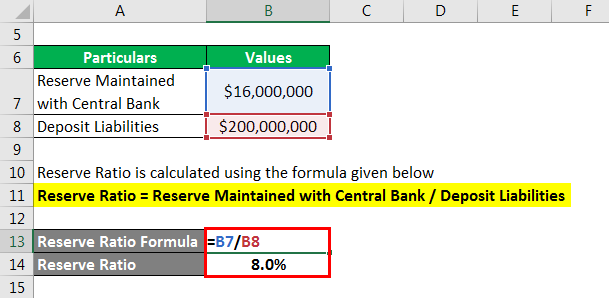

Reserve Ratio Formula Calculator Example With Excel Template

5 Percent Gst Calculator Gstcalculator Net

2015 5 Cent Fine Silver Coin Legacy Of The Canadian Nickel The Two Maple Leaves Silver Coins Coin Design Gold Silver Coins

Reverse Percentages Calculator Online

Mortgage Calculator App Google Search Mortgage Loans Mortgage Loan Calculator Reverse Mortgage

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Which Is Best Fixed Vs Adjustable Rate Reverse Mortgages

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

Reserve Ratio Formula Calculator Example With Excel Template

Realtor Mortgage Broker Deluxe Gold Ring Theme Business Card Zazzle Com Mortgage Brokers Online Mortgage Mortgage

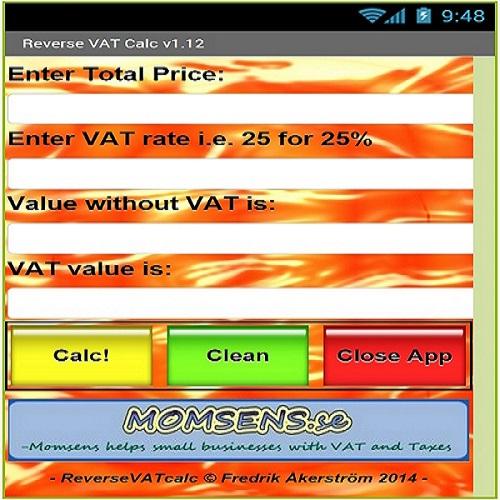

Backward Vat Calculator Accounting Finance Blog

How To Dodge Mortgage Insurance Fees When Applying For A Home Loan Infographic Mortgage Payment Calculator Mortgage Payment Home Mortgage

Free Workout Log1 Workout Log Workout Free Workouts

Reverse Tax Calculator Net To Gross

Reverse Mortgage Calculator Reverse Mortgage Pay Off Mortgage Early Mortgage Calculator

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis